2 new buys for my portfolio: CrowdStrike stock and a defence ETF

The cybersecurity and defence industries look poised for strong growth in the years ahead

I haven’t been doing much buying for my investment portfolio lately. With valuations across the market looking stretched, I’ve been happy to build up my cash pile.

However, I have made a few strategic trades here and there to diversify my holdings and position myself for future gains. With that in mind, here’s a look at two recent additions to my portfolio.

The leader in cybersecurity

I’ve been looking to get exposure to the cybersecurity industry for a while now. This industry is going to grow exponentially over the next decade as cyberthreats become more sophisticated (artificial intelligence is going to make the threat landscape a lot worse!). It’s also a relatively defensive industry. While businesses can cut back on other types of software (e.g. marketing automation software), they can’t cut back on cybersecurity – the risks associated with a cyberattack are simply too high.

The global cybersecurity total addressable market may reach $1.5 trillion to $2.0 trillion.

McKinsey & Company

In late October, I finally pulled the trigger and bought CrowdStrike (NASDAQ: CRWD) stock for my portfolio (in the low $300s). It’s widely regarded as the top company in the cybersecurity industry today. Over the last five financial years, its revenues have climbed from $250 million to $3.1 billion (a compound annual growth rate (CAGR) of about 65%). Looking ahead, Wall Street is forecasting revenue of $3.9 billion for the year ending 31 January 2025 followed by revenue of $4.8 billion the following year – a far higher level of growth than other major players such as Fortinet and Palo Alto Networks are generating.

Why is CrowdStrike so successful? Well, for starters it has a very powerful platform that offers endpoint protection, cloud security, identity protection, and threat intelligence. It also collects a ton of data from its customers and uses this to continuously update its threat detection capabilities. So, there’s a ‘network effect’ – the more customers it has, the better its offering gets.

Of course, CrowdStrike was responsible for the global IT outage back in July. This adds some uncertainty in the near term as customers may leave or try to negotiate better contracts, slowing down growth (we could see some volatility when it posts its Q3 earnings on 25 November).

Another issue to be aware of here is that the company’s forward-looking P/E ratio is about 90. This sky-high valuation doesn’t leave any room for error.

Given the near-term risks, I’ve started with a very small position here. I plan to build up a larger position over the next 12 to 18 months, buying on weakness. I can see this stock being a top 10 holding for me one day though. Over the next decade, I expect the company to grow significantly.

A defence ETF to hedge geopolitical risks

Another industry I’ve been looking to get exposure to is defence.

In recent years, elevated levels of geopolitical tension and conflict have become the new norm. I don’t expect this to change any time soon (especially with Donald Trump in the White House).

Given the backdrop, I think government spending on defence will remain high in the years ahead, particularly across Europe, where declines in defence spending since the Cold War have left inventories at rock-bottom levels.

According to a report from EconPol Europe, the European defence industry has seen more than 30 years of under-investment and there’s now a €1.8 trillion gap between what was spent on defence over that period and what would have been spent if the NATO target of 2% of GDP had been met.

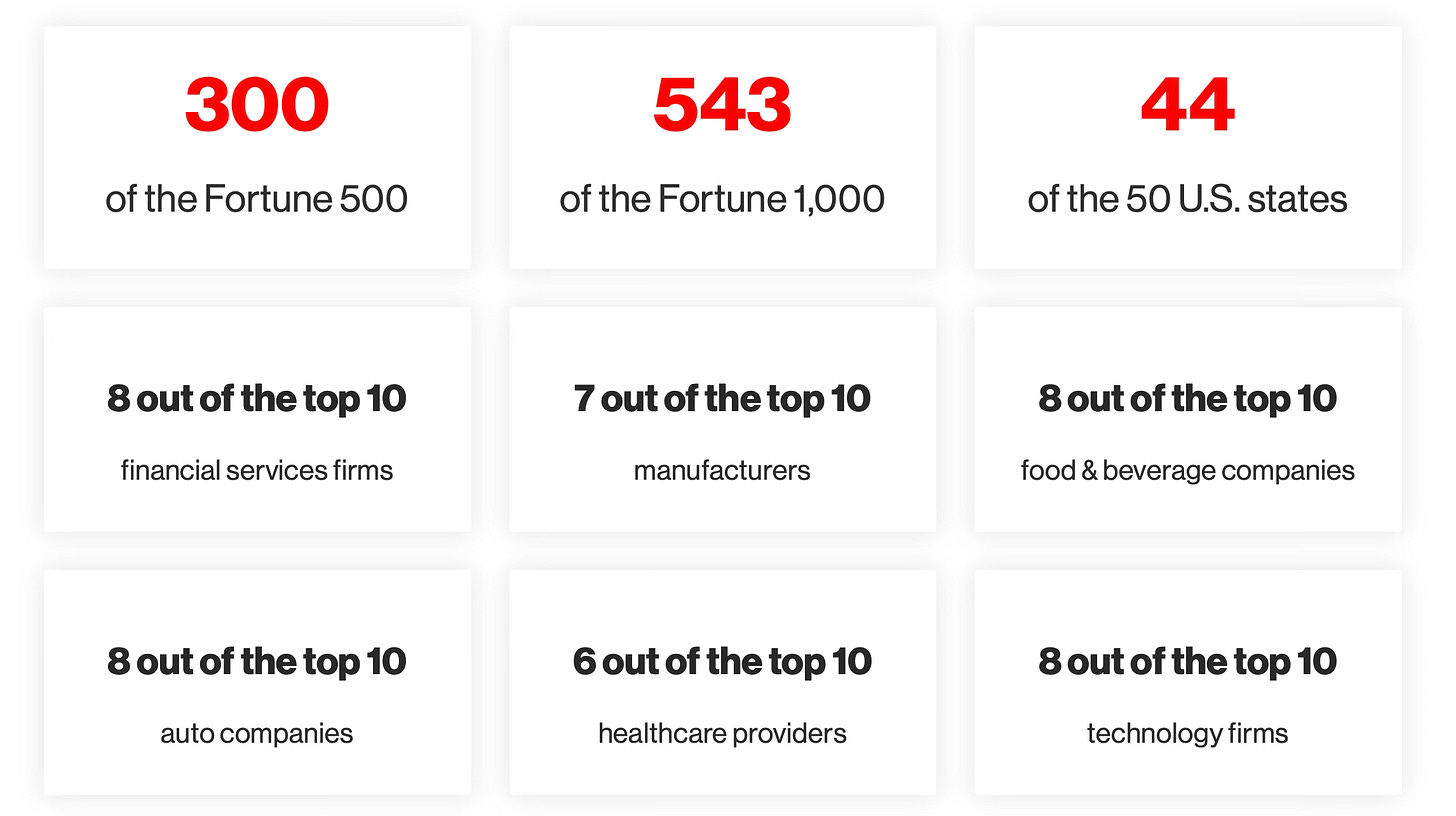

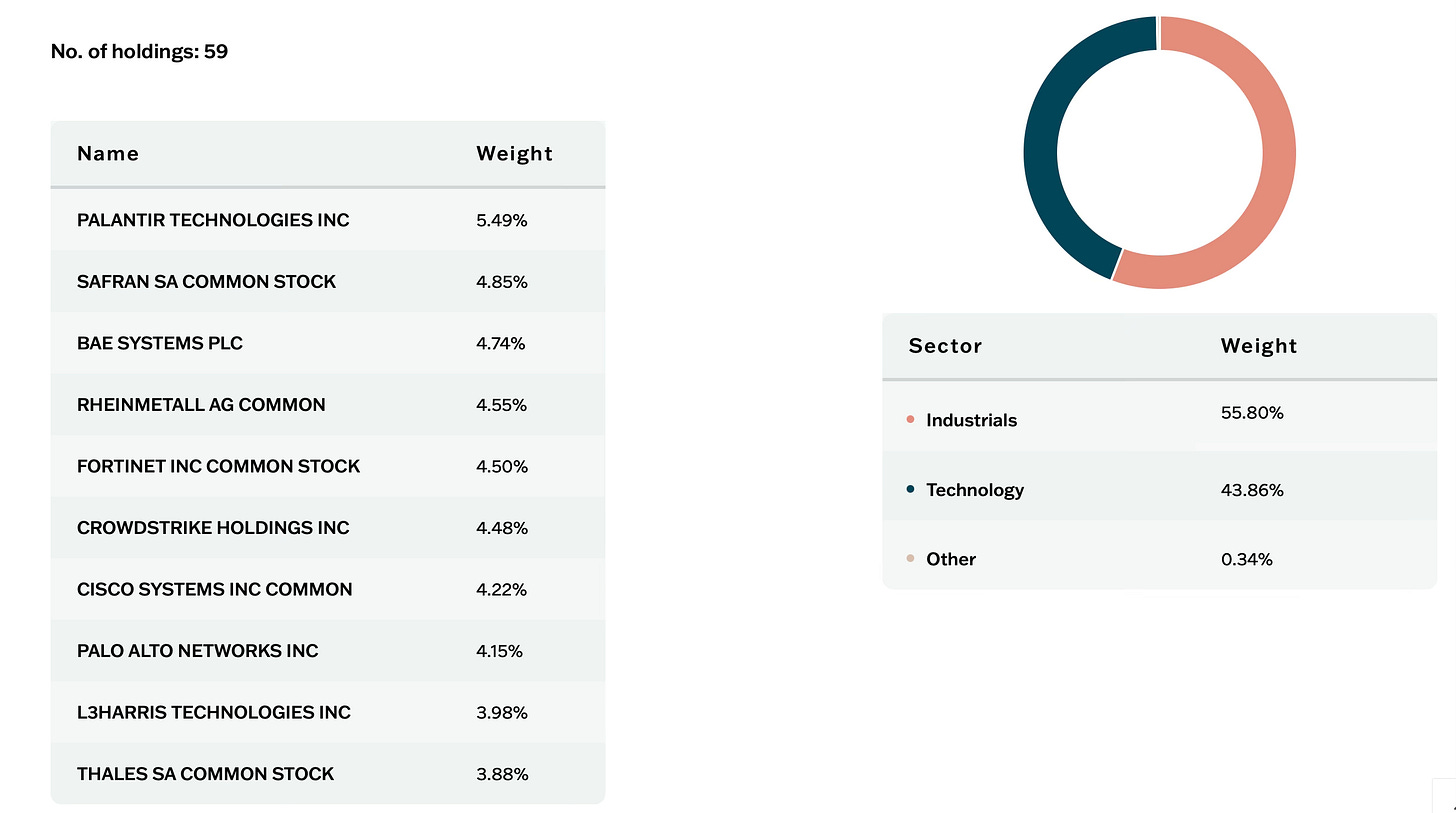

Now, I could have gone with an individual stock such as BAE Systems for exposure to the defence sector. But I decided to take a more diversified approach and buy the HANetf Future of Defence ETF (LON:NATP).

This provides access to a range of companies across the defence sector including the likes of BAE Systems, Rheinmetall, Safran, Thales, and L3Harris.

It also features technology companies like CrowdStrike, Palantir, and Fortinet, meaning I get more exposure to cybersecurity and AI.

Overall, I think it offers a nice mix of growth potential and defensiveness. With geopolitical tension and conflict continually threatening to destabilise the world’s financial markets, I see this ETF as a good hedge.

Edward Sheldon owns shares in CrowdStrike and the HANetf Future of Defence ETF. The information in this article is for general informational purposes only and should not be considered financial advice. Please consult a qualified financial professional before making any investment decisions.