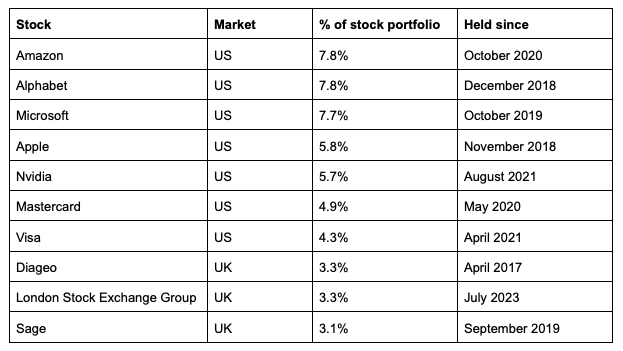

My top 10 stock holdings at the start of Q2 2024

This is how my portfolio was positioned at the start of the quarter

As an active investor who is always on the hunt for high-quality stocks to buy, I spend a fair bit of time looking at other investors’ portfolios. I find that this is a great way to generate investment ideas.

Today though, I’m going to flip things around and give others a look at my portfolio. With that in mind, here were my top 10 individual stock holdings at the start of Q2 2024.

My top 10 holdings

The table below shows my largest 10 stock positions at the start of the quarter. It also shows each stock’s weighting and the date I first bought it.

Big Tech at the top

My largest holding at the start of the quarter was e-commerce and cloud computing company Amazon (NASDAQ:AMZN). Now, Amazon doesn’t score as highly on the ‘quality’ front as some of my other holdings do. However, I’m quite bullish on the stock at present. This year, Amazon’s earnings per share are forecast to rise 42% thanks to cost cutting by CEO Andy Jassy – a higher rate of growth than all the other Big Tech stocks bar Nvidia (NASDAQ:NVDA).

Behind Amazon, we have two legendary tech companies, Alphabet (NASDAQ:GOOG) and Microsoft (NASDAQ:MSFT). These companies are both major players in cloud computing and artificial intelligence (AI). So, I see considerable long-term investment potential. Right now, Microsoft appears to be beating Alphabet in the AI race, however, I’m not writing off Alphabet just yet.

Then, we have Apple (NASDAQ:AAPL), which has been a bit of a laggard this year (down 11% in Q1). To be honest, I’m not particularly surprised by the recent underperformance here. After all, top-line growth has slowed dramatically (1% revenue growth forecast for this financial year). I’m still confident in the long-term growth story though – I expect growth to pick up when AI-enabled iPhones are released (the company is reportedly in talks with Google here).

My fifth-largest holding was chip designer Nvidia, which has been on a tear over the last 15 months due to excitement over its AI chips. Now, this is a company with huge potential. Ultimately, it’s at the heart of the AI revolution. I am a bit concerned about how far the share price has climbed in just 15 months (approx. +520%), however, so I have been trimming my holding recently to right-size my position.

Payments powerhouses

After the Big Tech companies, we have the payments giants Mastercard (NYSE:MA) and Visa (NYSE:V). These two stocks I just see as ‘no-brainers’. Over the next decade, trillions of transactions are set to shift from cash to card. So, I expect these businesses to continue growing at a healthy rate.

High-quality UK stocks

My 8th-largest holding was alcoholic beverages giant Diageo (LON:DGE). It’s the owner of Johnnie Walker, Tanqueray, and many other well-known spirits brands. This stock has been a bit of a dog recently due to a slowdown in Latin America and the Caribbean. However, I believe the company – which is well placed to benefit from increased interest in tequila (it owns Don Julio) – has the ability to turn things around.

We then have London Stock Exchange Group (LON:LSEG), which of the 10 stocks is the most recent purchase. The reason I bought it was that, after the company’s acquisition of Refinitiv, it’s now one of the largest players in the financial data space. I’m also excited about the company’s recent partnership with Microsoft. As a result of this partnership, the company is set to roll out some exciting new AI features for its customers.

Finally, we have Sage (LON:SGE). It’s a UK-based accounting and payroll software business. I see this company as a good play on the digital transformation theme. I think it’s well placed in a world in which small and medium-sized companies are looking to streamline and automate their back-office processes.

Tech heavy

Looking at the list of stocks as a whole, it’s obviously quite tech heavy. This adds some risk since technology stocks can be volatile at times.

I’m comfortable with this risk, however. Today, we are in the midst of a technology revolution (aka the ‘Fourth Industrial Revolution’), and I believe that it has a long way to go.

Edward Sheldon has positions in Amazon, Apple, Microsoft, Alphabet, Visa, Nvidia, London Stock Exchange Group, Sage, Diageo, and Mastercard. The information in this article is for general informational purposes only and should not be considered financial advice. Please consult a qualified financial professional before making any investment decisions.