An insider at Snowflake just bought $10 million worth of stock

No one has more information in relation to a company’s prospects than its executives and directors.

One thing I always keep an eye on is insider buying. Corporate insiders tend to have a significant information advantage over the rest of us so their stock purchases can provide valuable trading signals.

Recently, I spotted a substantial insider purchase at fast-growing data storage and analytics services company Snowflake (NYSE:SNOW). It’s a stock I have a small position in.

Here’s a look at the trade in more detail.

A huge insider stock purchase

SEC filings show that on 7 June, Snowflake board member Mike Speiser purchased 76,200 SNOW shares at a price of $131.09 per share.

This trade cost the insider just under $10 million.

Beyond its large size, this insider transaction looks interesting to me for a couple of reasons.

Firstly, Mr. Speiser – who is a managing partner at venture capital firm Sutter Hill Ventures – was Snowflake’s founding CEO from 2012 to 2014. So, he’s likely to have a very good understanding of the company and its prospects.

Secondly, Mr. Speiser has been a seller of Snowflake stock in the recent past. In July last year, for example, he offloaded about $89 million worth of shares. Therefore, his view on the stock appears to have changed.

It’s worth pointing out that Mr. Speiser became a billionaire after Snowflake went public in September 2020. So, $10 million is most likely small change to him.

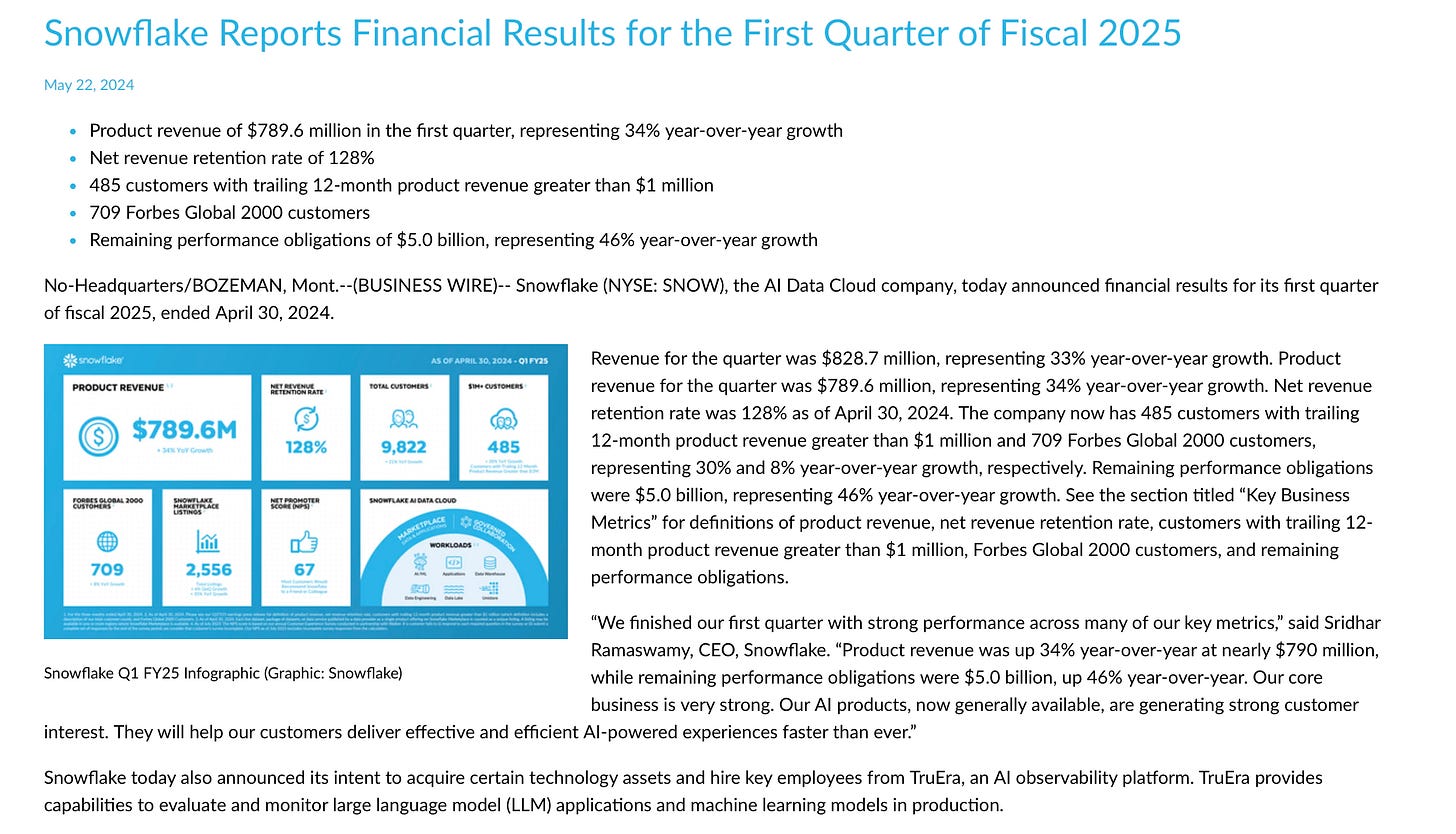

Still, I see the trade as noteworthy. Like a lot of software stocks (Snowflake operates a software-as-a-service model), Snowflake has been smashed recently due to the higher-for-longer interest rate environment and decelerating revenue growth. Back in February, it was trading above $230. Today however, it’s near $130. That's a big fall given that recent results were pretty solid (see screenshot below).

Close to the bottom?

It’s worth noting that renowned technology investor Brad Gerstner of Altimeter Capital (who has a large position in Snowflake) believes that we are close to the bottom in software.

Speaking on CNBC’s Halftime Report last week, he stated that the software sector is currently trading 20% below its 10-year average multiple for free cash flow and revenues, and that the ‘smart money’ is now buying.

His view was that it’s a good time to go hunting in the software space.

With that in mind, I may just follow Mr. Speiser and buy more Snowflake stock for my portfolio.

It’s a higher-risk stock as profits are still small and the valuation is high.

However, as one of the world’s preeminent data storage and analytics companies (it currently serves over 700 of the Forbes Global 2000 businesses), I think it has a huge amount of potential in today’s data-driven world.

Edward Sheldon owns shares in Snowflake. The information in this article is for general informational purposes only and should not be considered financial advice. Please consult a qualified financial professional before making any investment decisions.