Why software is one of the hottest areas of the market right now

Software stocks are on fire and the momentum could continue in 2025

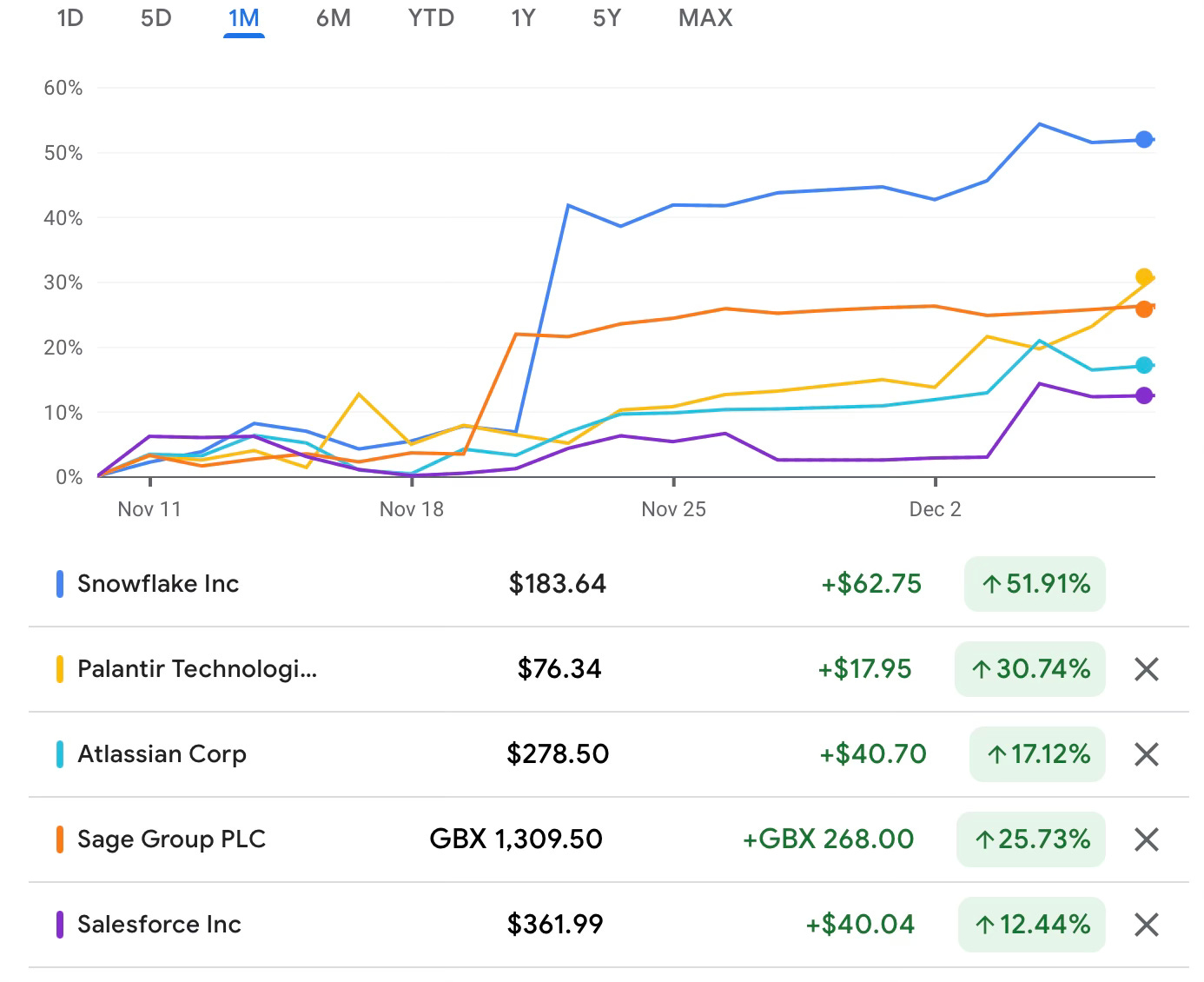

After a period of underperformance earlier in the year, software stocks are now flying. In recent weeks, many stocks in this area of the market have generated double-digit gains in the blink of an eye.

Here, I’m going to look at what’s driving this explosive move. I’ll also look at how I’m playing it.

The underperformance explained

In the first three quarters of 2024, there were two key factors that held software stocks back.

One was artificial intelligence (AI). Given its rapid development, many businesses were hesitant to commit to new software investments (they wanted to get a better understanding of AI’s potential first). This slowed top-line growth for a range of companies within the sector including the likes of Salesforce, Atlassian, and Adobe. Salesforce, for example, posted its lowest ever quarterly revenue growth forecast in May.

The other factor was uncertainty in relation to the economy and the US election. This led many firms to take a more cautious approach to tech spending. The businesses most affected here were those offering non-essential software solutions (e.g. marketing automation). These are not as crucial as some other software solutions (e.g. cybersecurity).

Together, these factors created a messy backdrop for software stocks. Company-specific issues like CrowdStrike’s global IT outage didn’t help. This misstep sent its share price down more than 40%. Overall, it was a frustrating period for software investors.

Why software stocks are ripping

Recently, however, the outlook for the sector has changed dramatically. For a start, there’s more economic clarity now that the US election is over. Donald Trump is seen as economy-friendly, and a healthy economy in the US in the years ahead could lead to increased corporate IT spending budgets. This should result in more growth for software companies.

Secondly, firms (and investors) are realising that the AI solutions that software companies are embedding into their products could actually add a lot of value, and help to drive growth and efficiency. ‘AI agents’ offered by companies like Salesforce are a good example. In Salesforce’s recent Q3 earnings call, CEO Marc Benioff explained that its ‘Agentforce’ AI agents can be genuine collaborators, working alongside humans to analyse data, make decisions, and resolve issues quickly. These kinds of innovative products could potentially attract new customers and boost revenue growth for software companies.

Another factor behind the resurgence in software stocks is the potential for a more relaxed regulatory environment under a Trump administration. This could potentially lead to more M&A activity in the software space (benefitting small and mid-sized companies).

Finally, uncertainty in relation to export restrictions for the semiconductor industry is leading to capital coming out of that sector and into software. Investors are also shifting their focus from the first phase of AI (building the infrastructure) to the second phase (software companies rolling out AI solutions).

Put all this together and it’s not hard to see why software stocks are on fire. Given this combination of factors, I wouldn’t be surprised to see the sector’s momentum continue well into 2025.

How I’m playing software’s resurgence

Zooming in on my own portfolio, I’ve got quite a few software stocks today so I’m benefitting from the sector’s move to the upside. Software names I own include Microsoft (business productivity software), London Stock Exchange Group (financial data software), Sage (accounting software), Snowflake (data analytics software), CrowdStrike (cybersecurity software), Shopify (e-commerce software), Gamma Communications (business communications software), and Cerillion (telecoms back office software). You could also potentially throw in Amazon (my largest holding) due to its cloud offering and Rightmove, which operates the UK’s largest property search portal. So, I have plenty of exposure overall.

Some of these stocks have more ‘quality’ than others. So, position sizes in my portfolio are different. For example, I see Amazon, Microsoft, LSEG, and Sage as high quality stocks so they are in my top 10 holdings. Snowflake, Shopify, and CrowdStrike, on the other hand, are smaller positions for me as I see them as more speculative holdings (profits are still small here).

That said, I am quite excited about some of these more speculative plays. Snowflake recently posted excellent Q3 results with revenue up 28% year on year. It’s clearly benefitting as companies move to explore AI (if you want to rollout AI you have to get your data right first). This is an expensive stock and it’s going to be volatile. But I see a lot of long-term potential. It’s worth noting that back in June, I highlighted a $10 million insider purchase here. Since then, the stock has risen about 40%, highlighting the power of insider transactions.

I’m also excited about CrowdStrike, which is one of my more recent buys. Today, cybersecurity is a top priority for organisations globally, making it an indispensable area of software investment. This stock is also expensive, but like Snowflake, I see huge potential. Recent Q3 earnings showed revenue growth of 29% and customer retention of 97%, which is impressive given the company’s misstep in July.

Edward Sheldon owns shares in Amazon, Microsoft, London Stock Exchange Group, Sage, Snowflake, CrowdStrike, Shopify, Gamma Communications, Rightmove, and Cerillion. The information in this article is for general informational purposes only and should not be considered financial advice. Please consult a qualified financial professional before making any investment decisions.